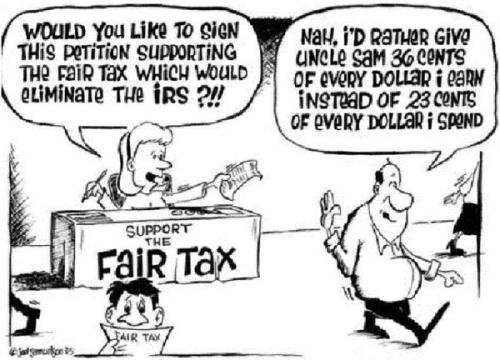

Tax change advocate Bill Spillane has proposed a ‘FairTax’ alternative for the United States — a flat retail tax that would replace income and payroll taxes, along with a rebate for those who can’t afford it. He feels that the current US income tax code is slowing America down and causing us all kinds of trouble, such as sending jobs overseas, and making locally made products more expensive. Parts of the idea are not totally new. A “flat tax” idea was discussed by Herman Cain in the last election, and back in the 90s, Bill Clinton and Jerry Brown debated the issue heatedly.

The FairTax idea is not merely a reform– it’s an actual replacement for all forms of federal income taxes, including estate taxes, capital gains, alternative minimum, self-employment etc.

According to Bill Spillane’s recent appearance on Coast to Coast AM, People will have more money in their pockets and can decide how they would like spend it.

Here is how it works:

According to the plan, everyone will pay the same flat tax rate at the cash register– 23%. Legal residents will be eligible for a “prebate”– a rebate on taxes based on the size of their family, which makes the tax progressive, adding that the amount of tax a person pays will depend on how much they spend buying items. One benefit of FairTax is that it will create enormous job opportunities in the US, as new business investment comes flooding in, he said.

If you like the idea, contact your local political representatives to push for the H.R. 25 FairTax Act (Congress, currently has 67 Representatives as co-sponsors) and the S. 155 FairTax Act (Senate, currently has 6 Senators co-sponsoring).

You must be logged in to post a comment.